Responsible banking

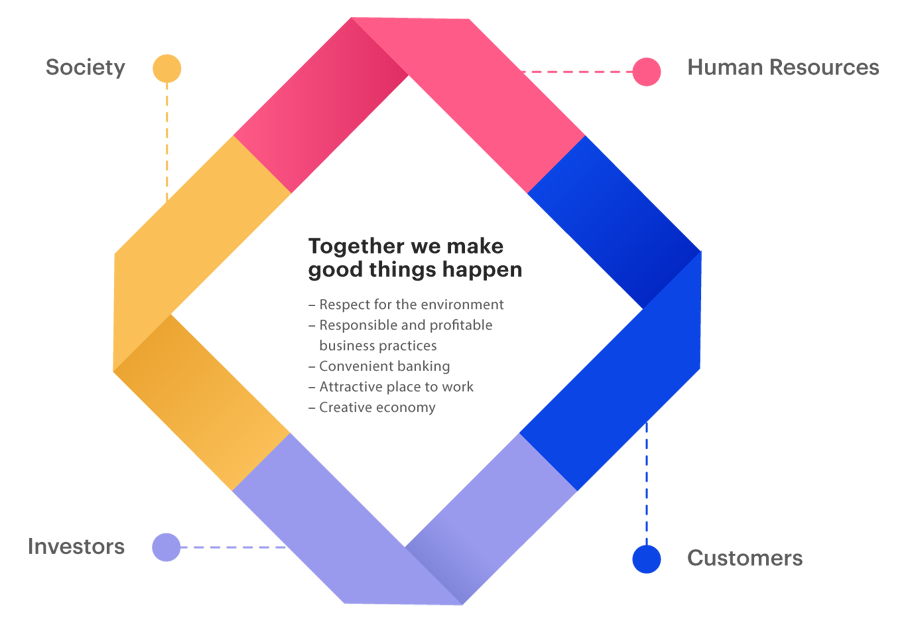

Arion Bank is a strongly capitalized bank which provides universal banking services to companies and individuals with the aim of creating future value for the benefit of our customers, shareholders, partners and society as a whole. Arion Bank’s sustainability policy bears the title Together we make good things happen and indicates that the Bank intends to act as a role model by promoting responsible and profitable business practices, which take into account the environment, the economy and the society in which we live and work.

.jpg)

We refer to Arion Bank’s values as cornerstones and they are designed to provide guidance when making decisions and in everything the management and employees say and do. The cornerstones address our role, mentality and conduct and they are: we make a difference, we get things done, we say what we mean. The Bank’s code of conduct has been approved by the Board of Directors and is designed to support responsible decision making.

Sustainability policy

We want to act as a role model by promoting responsible and profitable business practices, which take into account the environment, the economy and the society in which we live and work. We try to see things from our customers’ viewpoint and strive to do better today than we did yesterday.

We work in an attractive workplace where knowledge creates future value for the benefit of our customers, investors and society as a whole.

The diagram below shows the main stakeholders and our main focuses in sustainability.

Sustainability reporting

At Arion Bank we aim to ensure that sustainability is part of the Bank's day-to-day activities, its decision-making and processes. Information on sustainability has once again been prepared in accordance with the Global Reporting Initiative standard, GRI Core, which helps companies and institutions share information relating to sustainability transparently and in a way which enables comparisons. When sharing information on non-financial factors of the business the ESG reporting guide for the Nasdaq Nordic and Baltic exchanges and the 10 Principles of the UN Global Compact are also used a reference. Furthermore, we look to the UN Sustainable Development Goals.

Responsible lending and investment

Financial capital can be a force for the good and how banks manage capital can have a decisive impact on the progress of sustainable development in countries individually and on a global scale. This is why Arion Bank endeavours to continuously create a better business and to have a positive impact.

The Bank’s Asset Management division and its subsidiary Stefnir had more than ISK 1,000 billion in assets under management at the end of 2019. Institutional Asset Management has rules of procedure on responsible investment which incorporate the three basic criteria of sustainability: environmental, social and governance. So not only financial criteria, but also other relevant criteria, are taken into account when analyzing investments and developing clients’ asset portfolios. See the section on Responsible Investment on the Bank’s website and the section on Asset Management for more details.

In 2018 the Bank’s credit rules were updated to include provisions incorporating environmental, social and governance factors when evaluating loans. In 2020 the aim is to go one step further and evaluate the Bank’s loan portfolio according to green criteria, set ambitious targets on green lending and adopt a policy on loans to individual sectors from a sustainability viewpoint.

In September Arion Bank became a signatory to the new UN Principles for Responsible Banking, which were presented at the UN General Assembly. At Arion Bank we place great importance on working responsibly and in harmony with society and the environment. The Principles for Responsible Banking are closely aligned with the Bank's strategy and we are delighted to become one of the first banks to announce our intention to work in accordance with the Principles.

Man-made global warming is one of the greatest threats to humanity and we all need to make an effort to reduce the impact. Climate change is not a problem that will solve itself and much has to change over the next few years and decades. These changes require funding and it is vital that the world's banks lead the way when it comes to renewable energy and developing greener infrastructure.

The principles will help us on this journey, as will the Bank’s recently adopted environment and climate policy and medium-term targets, which state that we intend to turn our focus on to financing projects which relate to sustainable development and green infrastructure and that we will evaluate our loan portfolio according to green criteria and set ourselves ambitious targets in this respect.

Benedikt Gíslason, CEO of Arion Bank

Our commitments, certifications, qualifications and participation in sustainability

UNEP FI and Principles for Responsible Banking - PRB

In July 2019 Arion Bank became a signatory to UNEP FI, United Nations Environment Programme Finance Initiative which is a partnership between United Nations Environment and more than 250 financial institutions across the world working to understand today’s environmental, social and governance challenges.

In September Arion Bank became a signatory to the Principles for Responsible Banking (PRI) which were devised by UNEP FI and 30 international banks. These principles, presented during the autumn at the start of the UN General Assembly, align banking with international goals and commitments such as the UN Sustainable Development Goals and the Paris Climate Agreement. Arion Bank was one of the first banks to announce its support for the principles, with 130 banks from 49 countries signing up.

Further information on Arion Bank’s involvement with the principles

Forum for climate action and green solutions – Green by Iceland

In September 2019 Arion Bank became one of the founding members of a joint business and government forum on climate action and green solutions called Green by Iceland. The role of Green by Iceland is to strengthen the partnership between the business sector and the government in order to reduce greenhouse gas emissions and to bring about carbon neutrality by 2040. The forum will also work with Icelandic companies to market green solutions internationally and to underpin Iceland's reputation as a global sustainability leader.

United Nations Principles for Responsible Investment, UN PRI

In late 2017 the Bank became a signatory to the United Nations Principles for Responsible Investment (UN PRI). The principles are designed to help investors understand the effect of environmental, social and governance (ESG) issues on investment and thereby encourage signatories to the principles to take non-financial factors into account when making investment decisions. In 2019 the first progress report by the Bank’s Asset Management division on responsible investment was published. For more information on responsible investment see the Asset Management section.

UN Global Compact, the UN’s initiative on sustainability

Arion Bank has been a signatory to the UN Global Compact, the UN’s initiative on sustainability, since the end of 2016 and we submit a progress report to the UN every year. The compact sets out 10 principles on human rights, the labour market, the environment and anti-corruption.

Ministry of Welfare’s equal pay symbol

In the autumn of 2018 Arion Bank was awarded the Ministry of Welfare’s equal pay symbol after having been certified by the standards agency BSI á Íslandi, the first Icelandic bank to gain this recognition. The Bank first gained equal pay certification in 2015 and has since undergone a pay assessment annually. The Bank has achieved a great deal in equality issues in recent years and this subject is covered in more detail in the section on Human Resources and Non-financial Information.

IcelandSIF - Iceland Sustainable Investment Forum

Arion Bank has been an active participant in shaping and developing responsible investment in Iceland and has had representatives in the board and working groups in IcelandSIF, Iceland Sustainable Investment Forum. Arion Bank was one of the founding members of the organization in 2017.

City of Reykjavík and Festa’s Declaration on Climate Change

In November 2015 Arion Bank was one of 103 signatories to the City of Reykjavík and Festa’s Declaration on Climate Change. One of the main tasks concerning climate change is to map the environmental impact of operations and to systematically reduce the negative effects. The Bank has published its environmental accounts since 2016. Further information on environment and climate issues at Arion Bank can be found here and the section on Non-financial Information.

Excellence in corporate governance

Arion Bank was recognized as a company which had achieved excellence in corporate governance following a formal assessment based on guidelines on corporate governance issued by the Icelandic Chamber of Commerce, the Confederation of Icelandic Employers, and Nasdaq Iceland, first in 2015 and again in 2019. This recognition is given following a comprehensive audit by an independent assessor of corporate governance at the Bank, such as governance by the Board of Directors, sub-committees and management. It applies for three years. For further information see the sections on Corporate Governance at Arion Bank and on Non-financial Information.

Festa – sustainability centre

For a number of years Arion Bank has been an active partner of Festa, a sustainability centre. Festa’s role is to add to the expertise on sustainability at companies, institutions and organizations so that they can adopt sustainable business practices.

UN Women/UN Global Compact Empowerment Principles

The Bank has supported the UN Women/UN Global Compact Empowerment Principles since 2014. These are international declarations and treaties under the auspices of the United Nations which companies and institutions can use as guidelines when implementing responsible working practices, irrespective of geographic location or sector and primarily concern advancing gender equality. For further information see the sections on Equality at Arion Bank and on Non-financial Information.

ESG reporting guide for Nasdaq

The ESG Reporting Guide for the Nasdaq Nordic and Baltic exchanges provides guidance on data disclosure and the environmental, social and governance impact of listed companies. Since 2016 Arion Bank has taken these criteria into account when reporting on sustainability. The criteria formally came into effect in 2017. For further information see the section on Non-financial Information.

Kolviður

In 2019 Arion Bank and Kolviður reached an agreement on offsetting the carbon emissions produced by the Bank's activities. Kolviður will fix the carbon in plants and soil through soil reclamation and forestry to offset the carbon emissions resulting from the Bank's activities in 2019. Kolviður is expected to plant up to 5,000 trees for the operating year. This refers to emissions produced, for example, by vehicles used in the Bank's operations, its business premises, waste and business flights.

GRI - Global Reporting Initiative

Global Reporting Initiative has developed a standard which helps companies and institutions report their progress in environmental, social and economic issues in such a way that it enables a direct comparison of data between companies. For the second time the Bank is presenting information on sustainability in the Bank’s operations in accordance with the GRI Core standard. See Arion Bank’s GRI index here.

UN Sustainable Development Goals

At the beginning of 2020 the executive committee of Arion Bank approved six Sustainable Development Goals which the Bank intends to focus on. These goals are number 5 on gender equality; number 7 on affordable and clean energy; number 8 on decent work and economic growth; number 9 on industry, innovation and infrastructure; number 12 on responsible consumption and production; and number 13 on climate action.

The Bank’s operations, including action on gender equality, our policy and targets on environment and climate issues, support for innovation and the business sector as a whole, state-of-the-art digital services and active participation on the development of the economy closely align with these sustainable development goals

The Bank’s key sustainability focuses are closely aligned with goal number 5 on gender equality, number 8 on decent work and economic growth, number 9 on industry, innovation and infrastructure and number 13 on climate action.

.jpg)

Steering committee on sustainability

Arion Bank has a steering committee on sustainability. The project manager for sustainability oversees the committee’s activities and the CEO is the person responsible for these activities. At the beginning of the year two managing directors were on the steering committee on sustainability, i.e. the managing directors of Asset Management and Corporate Banking. The committee also included the heads of Human Resources, Marketing and Corporate Communications. At the end of the year changes were made and now the managing directors of Retail Banking, Markets and Corporate & Investment Banking are all on the committee along with the heads of Marketing and Corporate Communications.

Suppliers

The Bank's strategy is to create future value for the benefit of its customers, shareholders, partners and society as a whole, and in keeping with this the Bank seeks to source its supplies from local providers as far as possible, provided they meet the requirements on quality and price.

Nearly all of the Bank’s key suppliers operate in Iceland. Although the supply chain does extend overseas, the first link is usually here on the domestic market. In fact there is only one international company in the top 10 biggest suppliers and only 11 in the top 50. Business with international suppliers increased in 2019, mainly due to the implementation of major software solutions which required overseas expertise.

The majority of the Bank’s international suppliers are connected to the buying of software, advisory services and IT services. Hardware is almost entirely acquired from Icelandic suppliers.

Buying is divided between the 50 main suppliers as follows

Meticulous buying process

Our employees are committed to working to the highest standards. In 2019 the Bank reviewed the questions in its assessment of suppliers and their commitment to equality, labour laws and environmental and climate issues. A new supplier assessment process was introduced at the beginning of 2020. The suppliers’ commitment to these issues will have an impact in the future on how willing the Bank is to do business with them. The Bank will regularly assess the performance of suppliers with which it has long-term business relationships. This assessment is conducted in accordance with the relevant agreement with the supplier.

The Bank’s environment and climate policy, approved by the Board of Directors in December 2019, requires our suppliers to take into account the environmental and climate impact of their activities. Furthermore, when comparing similar offers from suppliers, environmental and climate considerations will be decisive in our decision. The Bank’s goal is to reduce emissions of carbon dioxide and other greenhouse gases from our activities by at least 40% by 2030 and to carbon offset all these emissions.

A secure financial system – for the benefit of society

Society relies on having an effective and secure financial system and Arion Bank, along with other financial institutions, plays a key role in ensuring that such a system exists in Iceland.

We create our business on the basis of sound organization, skilled employees, robust internal controls and effective and secure systems.

Ensuring secure movements of capital and safeguarding the assets and information entrusted to it are duties the Bank takes very seriously. The Bank is ever alert to all kinds of financial crimes and takes every precaution to minimize the damage such crimes can have on customers, the Bank's operations and society as a whole.

We prioritize measures to prevent:

- Financial crimes such as money laundering, terrorist financing, fraud, and bribery and corruption.

- Conflicts of interest.

- Market manipulation and insider misconduct.

- Cybercrime.

We try to ensure that we do not do business with anyone conducting illegal activities or subject to international sanctions. We place great importance on knowing our customers and others we work with and monitor financial transactions in order to identify transactions which could constitute illegal conduct. The Bank is also vigilant towards cyber-attacks and online scams, which are increasing threats as digital banking gains popularity. See information about cyber security on our website.

However, no form of monitoring is as effective as an alert and vigilant employee who receives regular training to learn to recognize and respond to suspicious behaviour. Every year employees undergo training to maintain their knowledge, including on measures against financial crime, security issues and the handling of confidential information.

Any suspicions of illegal activities by our customers are reported to the police without exception, and the Bank does its utmost to help the authorities with their enquiries.

Arion Bank has also adopted a policy on whistleblowing, whereby employees are encouraged to report any suspicion of inappropriate or illegal activity by the Bank, its employees or partners. The Bank keeps the source of all such tip-offs confidential and protects the identity of anyone coming forward to make their suspicions known. Employees can also make anonymous tip-offs. All reports of potentially illegal conduct are investigated by the Bank's internal control units and referred to the relevant law enforcement authorities as required. Employees and other people are also given the opportunity to send tip-offs directly to the Financial Supervisory Authority.

Internal rules and controls

Arion Bank employees are well aware that the Bank’s activities have an impact on different groups and on society as a whole. We have adopted procedures, a code of ethics and policies on different aspects of operations, including disclosure, data protection, information security, money laundering and equal opportunities.

Rules and terms of business on the Bank’s website

Managing risk and taking informed decisions is a crucial component of the Bank's activities and its responsibility towards society. Risk management is therefore a core activity within the Bank. The Bank’s policy is to have in place an active risk management function which analyzes and measures risk and takes action if it exceeds defined limits. At the same time as publishing the Annual Report, the Bank also releases Pillar 3 Risk Disclosures which address the main risks and how to manage them.

Further information on internal controls, i.e. risk management, internal audit, compliance and data protection at Arion Bank can be found here.

Corporate governance

Good corporate governance helps to foster open and honest relations between the Board of Directors, shareholders, customers and other stakeholders, such as the Bank's employees and the general public. Corporate governance also lays the foundations to responsible management and decision-making, with the objective of generating lasting value. The Board of Directors places great importance on good corporate governance and re-evaluates its governance practices regularly on the basis of recognized guidelines on corporate governance.

Further information on corporate governance at Arion Bank and the corporate governance statement can be found here .