Funding and liquidity

In 2019 Arion Bank continued to work on diversifying its funding, such as by issuing subordinated bonds and bonds in ISK and foreign currencies. Domestically the Bank issued covered bonds, subordinated bonds and commercial paper.

Combination of total funding

EMTN issues

In 2019 Arion Bank issued ISK 14 billion under its EMTN program.

In November 2019 the Bank repurchased €258 million (ISK 35 billion) of €300 million bonds maturing in June 2020. All received offers were accepted.

Subordinated debt issues

In 2019 Arion Bank concluded three subordinated issues in foreign currencies, €5 million in March, NOK 300 million in July and SEK 225 million in December.

The Bank also issued two new subordinated bonds series in Icelandic króna, totalling ISK 5.7 billion.

The total issuance of Tier 2 capital was ISK 13.6 billion in 2019.

The bonds are eligible as Tier 2 capital under the Icelandic Financial Undertakings Act No. 161/2002. The Tier 2 bond issue strengthens the Bank’s own funds and is a milestone towards reaching a more optimal capital structure.

Maturity profile

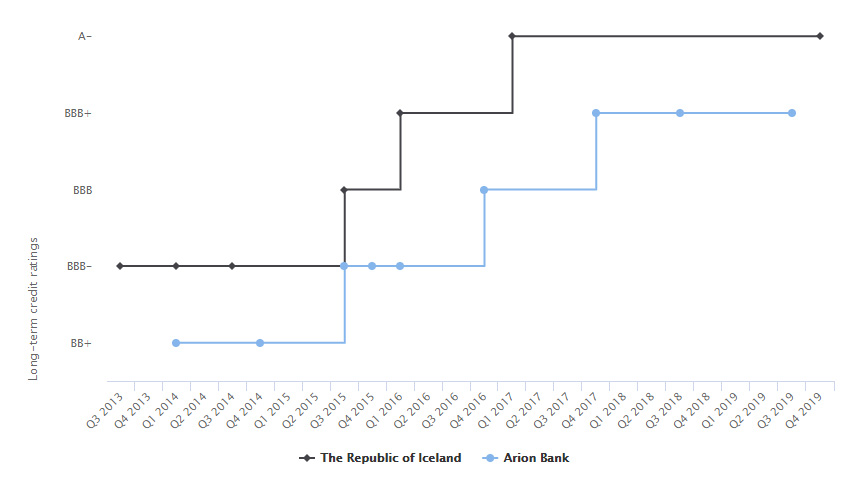

Credit rating

Standard & Poor’s (S&P) affirmed Arion Bank’s credit rating at BBB+ but downgraded the outlook from stable to negative. The short-term rating is A-2.

S&P said that the revised outlook takes into account the challenges in the Icelandic banking environment and points out that an economic downturn is expected in 2019, along with falling interest rates, continued high tax rates and fierce competition from the pension funds. S&P believes that these factors will negatively affect the Bank’s profitability. S&P also notes that GDP growth is expected once more in 2020.

Standard & Poor's (S&P)

| Category | Arion Bank | The Republic of Iceland* |

|---|---|---|

| Long term | BBB+ | A |

| Short term | A-2 | A-1 |

| Outlook |

Negative | Stable |

| Last rating action |

23 July 2019 | 17. May 2019 |

| S&P rating report | 15 December 2017 |

*Foreign currency obligations. Please visit www.cb.is for further information.

Credit rating - timeline

Issues of covered bonds and commercial paper

Arion Bank continued to issue covered bonds which are secured under the Covered Bond Act No. 11/2008. In 2019 the Bank issued covered bonds amounting to ISK 32,200 million.

Arion Bank renewed its agreement with Kvika, Íslandsbanki and Landsbankinn on market making for covered bonds issued by Arion Bank on Nasdaq Iceland. The purpose of the agreement is to stimulate trading with benchmark covered bonds issued by the Bank.

In recent years Arion Bank has issued commercial paper on the domestic market. During the autumn the Bank decided to stop issuing commercial paper and no further issues are planned for the time being. Commercial paper amounting to ISK 14.5 billion was issued in 2019. Outstanding commercial paper at the end of 2019 amounted to ISK 1,680 million.

In 2019 Arion Bank fully prepaid the bond series Arion CB 2, a total of ISK 81 billion.

Liquidity and liquidity risk

Arion Bank is partly funded with deposits from individuals, corporations and pension funds. One of Arion Bank's key objectives is to maintain a strong liquidity coverage ratio (LCR) which is calculated according to rules issued by the Central Bank of Iceland. LCR takes into account European liquidity regulations based on Basel III standard and addresses risk factors relating to the stickiness of deposits and the maturity mismatch of the assets and liabilities. At the end of 2019 the Bank's LCR was 188% and the ratio for foreign currencies was 334%, well above the minimum requirement stipulated by the Central Bank of Iceland.

The Bank’s net stable funding ratio, NSFR, was 116% at the end of 2019 and 155% in foreign currency. This ratio measures the proportion of Bank’s available stable funding to necessary stable funding according to a method which takes into account the liquidity of assets and the maturity of liabilities. These ratios indicate that the Bank has stable funding.