Retail Banking

Retail Banking provides a wide range of high quality financial service to retail customers and companies through our branch network across Iceland. The Bank operates 19 branches and a call centre and our digital channels enable our customers to do their banking wherever and whenever it suits them best. The managing director is Ida Brá Benediktsdóttir.

.jpg)

Our main task in recent years has been to enhance the customer experience, both through digital channels and at our branches. As our customers increasingly migrate towards digital services, the Bank has focused on adding to the range of digital service channels and by adapting our branch network to customers’ changing needs. Many of Retail Banking's employees at the headquarters and front line underwent focused service training during the year based on the lean management model, a program we call A Plus Service. The division has sought to boost efficiency by reducing overheads and the number of square metres used in the branch network, while at the same time making it easier for customers to use self-service banking options through digital channels.

Organizational changes were made at Arion Bank during the year, the aim of which was to simplify the Bank's structure and strengthen its business segments. One of these changes was to transfer specialist knowledge such as legal services for product development and marketing to the Retail Banking division. This has added depth to the division’s expertise and enhanced efficiency.

Convenient banking

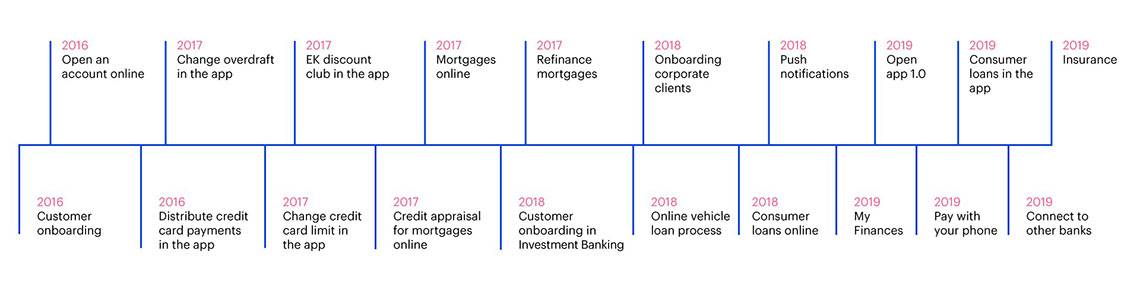

Banking services have evolved rapidly in recent years and it is vital we can offer customers the latest digital technologies. Arion Bank has set itself the goal of being the leading digital bank in Iceland and our customers have been quick to adopt the new products we have launched. Nowadays the vast majority of contact with customers is through digital channels such as the app and online banking.

Arion Bank has set itself the goal of being the leading digital bank in Iceland and our customers have been quick to adopt the new products we have launched. Nowadays the vast majority of contact with customers is through digital channels such as the app and online banking.

A range of innovative products were released in 2019 and more are in the pipeline. The Arion app was made available to customers of other banks and customers were also able to obtain information in the app about transactions and the status of their accounts at the other Icelandic retail banks. Another innovation was enabling users to buy services from a third party, and customers can now buy insurance from Vörður via the app. Apple Pay and a payment solution for Android were enabled and customers can also get an unparalleled insight into their household finances with a new PFM solution designed in partnership with Meniga.

All the banks

Switch

user

My

finances

Insurance

in the app

Get debit cards

and credit cards

Open a

savings account

Pay with

your phone

... and much

more

These innovations and enhanced services in the app have resulted in a surge in the use of the app, and for the first time more customers now use the app than online banking. The Bank evaluates its performance in digital services according to Finalta’s Digital and Multichannel Benchmark and it shows that the Bank is among the global leaders in terms of digital sales and services. This has had a highly positive impact on the Bank’s efficiency and customer satisfaction. More than half of the Bank's core products, such as credit cards, debit cards and savings accounts are now sold digitally.

Focus on digital services at the branches

Our larger branches employ hosts to ensure that our customers receive the service they need. These hosts also provide guidance to our customers on our digital services. The branches are designed to support the focus on value-adding services from employees and self-service channels such as ATMs and online banking. Changes to the branch network were aimed at bringing greater efficiency and making services more readily accessible to our customers by reducing the size of our branches and prioritizing self-service channels. In order to reduce the Bank’s ecological footprint, all marketing and promotional material in the branches is now in digital format.

The branches are designed to support the focus on value-adding services from employees and self-service channels such as ATMs and online banking.

During the year the branch at Hella was modified and the Akureyri branch moved to a new location at Glerártorg. The new Akureyri branch has video conferencing equipment, and meeting and conference rooms which can be used by customers and to host various events. This branch also shares a space with the insurance company Vörður and customers can now obtain banking and insurance services in one place.

Digital vehicle financing

Since the Bank created its vehicle financing unit in 2012, we have assembled a team of experts in this field, resulting in loan growth and more satisfied customers. The department was significantly restructured during the year in order to reduce costs and to enable the Bank to offer even better financing terms. The digital application process and increased automation have helped us distinguish ourselves from our competitors since Arion Bank is the only lender on the market to offer this type of solution.

Mortgages via digital process

Arion Bank has been pioneer in developing mortgage products on the Icelandic market in recent years. In 2011 Arion Bank became the first bank to offer non-indexed, fixed-interest 5-year mortgages and was also the first Icelandic bank to launch a digital mortgage application process in 2017 which greatly simplified the entire procedure. Over the last two years around 64% of all mortgages to individuals have been via the digital mortgage process.

Last year interest rates on mortgages decreased as the Central Bank cut its rates. Arion Bank has consistently offered some of the best rate mortgages and also offers flexible loan options, including a lower repayments during parental leave.At year-end 2019 the Bank’s mortgage portfolio amounted to ISK 308 billion, compared with ISK 342 billion at year-end 2018. The decrease is due to the sale of a mortgage portfolio worth ISK 48 billion to the Housing Financing Fund, while new lending totalled ISK 14 billion.

Arion Bank has consistently offered some of the best fixed rate mortgages and also offers flexible loan options, including a lower repayments during parental leave.

The sale of a mortgage portfolio to the Housing Financing Fund fits in with the Bank’s focus on mediating capital rather than growing the loan portfolio. We underlined that the sale would not have any impact on customers and Arion Bank would continue to provide all services relating to the loans even though they were no longer owned by the Bank.

Simpler range of deposit accounts

The Bank’s range of deposit accounts was reorganized at the end of 2019 with the aim of simplifying what is on offer and to better ensure it meets customers’ needs. Customers can open new accounts via the app, their online bank account and at branches throughout the country. Our range of deposit accounts is split into two categories: firstly, accounts which are available to all customers, and secondly accounts which are restricted to a particular age group, such as a new deposit account with competitive interest rates for people aged between 15 and 35. Our customers have welcomed the new range of deposit products.

Serving small and medium-sized enterprises

SME Services specializes in providing services to small and medium-sized enterprises (SME) across all sectors. Special SME teams work at all the larger branches and are responsible for helping our customers get the services, loans and products they need at each location.

Improving the quality and efficiency of services by using digital solutions has been a key focus. Towards the end of 2019 the SME team relocated to Retail Banking and is now responsible for general business management, corporate product management and is spearheading digital development for SMEs and corporates.

The main focus in 2019 in SME loans was on pricing and portfolio management, while less emphasis was placed on lending growth in keeping with the Bank's strategy of profitability over growth. The loan portfolio broadly spans the Icelandic business sectors, e.g. real estate activities and construction, fishing industry and trade and services. The Bank has also had a strong market share in agriculture for many years.

Retail Banking’s active role in the development of the economy aligns with UN Sustainable Development Goals number 8 on decent work and economic growth and number 9 on industry, innovation and infrastructure.

The loan portofolio by sector 31.12.2019

Sales & marketing and product development in the spotlight

The Sales & Marketing department is part of Retail Banking and is responsible for developing long-term business relationships with the Bank's customers and how customers experience the diverse customer interfaces. This entails processing and analyzing data, developing the Bank's interfaces and contact points, marketing our products and services, event management, internal marketing and developing the Bank's image and branding. The department uses marketing which aligns with the Bank's strategy and future vision to achieve these aims.

Sales & Marketing is in charge of introducing sales targets. A special digital sales team is responsible for enhancing the customer experience, not just in online banking and the app but also through traditional channels such as the branches and the call centre. Collecting and analyzing data is vital in order to help the customers make good decisions and to use the Bank’s services and products as effectively as possible.

The future is digital

Our wide range of digital innovations have put us in pole position in terms of digital and convenient banking. The popularly of our digital products clearly shows that our customers welcome the enhanced service and usability offered by the Bank. We will continue on the same path in 2020 with the aim of building on our lead in this field.